After looking at my original my blog section “MY COMPANY” I decided it was getting over crowded and long winded, so I cut and chopped and hacked at it to create this second blog post with the relevant information to Assignment #1.

Links to Swire’s annual reports are listed below:

2016 Annual Report: http://www.swirepacific.com/en/ir/ar16_download.php

2015 Annual Report: http://www.swirepacific.com/en/ir/ar15_download.php

2014 Annual Report: http://www.swirepacific.com/en/ir/ar14_download.php

KEY QUESTIONS:

For someone new to accounting the annual reports are over-whelming, they consist of over 220 pages per report. Where do I start? I am concerned that I could be looking at these numbers and unfamiliar terms for a long time to make heads and tails of it. So far I have not found EBIT on my firms annual reports. After watching Maria’s lectures from weeks 3 and 4 and finding out my firm could call their statements other names I had to work out what reports were called and where they were located. My balance sheet was in fact called “Consolidated Statement of Financial position. One thing I really liked about Swire’s annual reports was the option to click on certain sections of the annual report and generate that part of the report with out having to scroll to the 200th page. Swire’s currency is in the Hong Kong dollar, the annual reports are in (millions), how much is a HK$? A HK$ is currently equal to approximately 17 Australian cents, which makes Swire’s 2016 Total Equity of 272,168 (million) HK$ equal to approximately $46,268 (million) AUD.

After reading the study guide chapters and carefully following through Maria’s lectures I found Swire’s;

- Consolidated Statement of Changes in Equity

- Consolidated Statement of Financial Position (balance sheet)

- Consolidated Statement of Profit or Loss & Consolidated Statement of Other Comprehensive Income, (income statements split in two)

- Consolidated Statement of cashflow.

Originally, I was unsure if my income statement was split in two. The information on my Statement of Other Comprehensive Income didn’t seem to be sufficient so I went back to the annual reports to look for an Income Statement, I found a Consolidated Statement of Profit and Loss where my profit value at the bottom equaled the profit value at the top of my Consolidated Statement of Other Comprehensive Income (Thanks Maria, Lecture 3 & 4). Still unsure if this was what I was needed I researched it and found that although profit and loss is not normally a part of an income statement, they can be merged together (rare to see), It is now included in my excel spreadsheet. Even though I didn’t need the cashflow statement for my step 4 spreadsheet I decided to view it as it is one part of the four-general purpose financial statements.

Something that really resonated with me was that Swire has an Equal Opportunity and diversity council. I currently sit on the steering committee for inclusion and diversity within BHP. if done correctly it can be a very powerful and successful tool to create great culture, safety and productivity. Click the link to view Swire’s diversity video: http://www.swirepacific.com/en/media/video_content.php?clip=27

There are also a lot of accounting terms I don’t understand such as “derivative financial statement and perpetual capital securities”, even after reading about them in the notes section.

KEY CONCEPTS:

Assets = Equity + Liabilities

2016:

Assets = 373,498 (346,945 + 26,553)

Equity = 272,168

Liabilities = 101,330 (75,183 + 26,147)

Does the equation work? 373,498 = 272,168 + 101,330. YES!

Swire clearly has a good grasp of all their sectors, their total equity and cash flow increases from year to year, They are constantly acquiring new ventures, building new property developments and new factories. Swire has some non-controlling interests shown on the bottom of the balance sheet, which have stayed at approximately the same value for four years.

When I first viewed Swire’s cash flow sheet after the rest of their financial statements, it appeared as though they didn’t have a lot of cash in their bank balance! It was only 6,450 HK$M, my initial thought was that was no where near enough for such a massive company! Especially when all their other amounts are so high, eg: 2016 Total Equity = 272,168 HK$M. I calculated the conversion and it was approximately 1,096 million $AUD! I am pretty sure that should carry them through!

CRITICAL BUSINESS AREAS

Being so diverse on a global scale a number of macroeconomic conditions are a major factor for Swire. Currency, tourist industry down turn, terrorism, coal glut and the list goes on!

The critical business area is the Property Sector with the majority of Swire’s cash flow coming from their property assets, (as shown in the graph below). If one of the other sectors has a loss/negative cash flow the property sector can prop it up, but what if the property sector takes a loss? Swire is one of Hong Kong’s largest commercial landlords with 12.3 million sq.ft. of lettable space and another 2.3 under development.

KEY CHALLENGES

Some of the key challenges for Swire is in the airline business, with such a fierce competition from other companies, oil prices and the current strength of the Hong Kong dollar. Part of Swire’s strategy plan is to increase maintenance resulting in less breakdown times, enhance high standards of service to the passenger and endeavoring to minimize the effect on the environment. Swire has already increased their cash flow from 870 HK$M in 2015 to 1,198 HK$M in 2016, showing their improvement strategies to be effective.

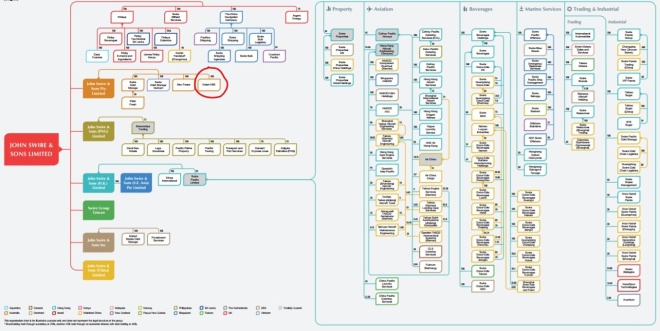

Other key challenges would be making sure they have the right management in place. with so many subsidiaries it would be hard to keep their finger on the pulse and to make sure all sections are pulling their weight.